When you swallow a pill, you rarely think about where it was made. But behind that small tablet is a global supply chain with real risks-especially when it comes to China and India manufacturing. These two countries produce most of the world’s generic drugs and active pharmaceutical ingredients (APIs), but their paths to quality couldn’t be more different. One is built on scale and cost. The other on compliance and consistency. And the FDA? It’s watching both closely.

Why FDA Monitoring Matters More Than You Think

The U.S. Food and Drug Administration doesn’t just inspect drug factories in America. It sends teams to China, India, and beyond. Why? Because nearly 80% of the world’s generic APIs come from these two countries. That’s not a guess-it’s a fact backed by DrugPatentWatch’s 2023 data. If a factory in Shanghai or Hyderabad cuts corners, it doesn’t just affect local patients. It affects millions in the U.S., Canada, and Europe. FDA inspections aren’t random. They’re targeted. Facilities with past violations, poor record-keeping, or unexplained contamination risks get flagged first. Between 2020 and 2023, Indian facilities received 30% fewer Form 483 observations-those are the FDA’s official notices of violations-than Chinese ones. That gap didn’t appear overnight. It’s the result of years of investment, training, and regulatory discipline.India’s Edge: Compliance Over Quantity

India isn’t the biggest manufacturer by volume. China is. But when it comes to FDA approval, India leads. Over 100 Indian pharmaceutical plants are currently FDA-approved. China? Only 28. That’s more than double the number of compliant facilities. And it’s not just about the count. Indian manufacturers have built systems that reduce human error. Bain & Company’s 2024 report found that leading Indian firms use digital monitoring across production lines to catch deviations before they become problems. That’s not just good practice-it’s a competitive advantage. India’s strength comes from its regulatory DNA. Since the 1970s, its patent laws have encouraged generic drug production. Over time, that pushed companies to align with international standards. Today, more than half of all Asia-Pacific contract research organizations (CROs) are based in India. That means more scientists, engineers, and quality control experts who speak English, understand FDA guidelines, and have worked on U.S.-marketed drugs. It’s why global pharma companies are shifting toward the China+1 strategy. Instead of relying on one country, they’re adding India as a backup. Why? Because when the FDA shows up at a plant in Mumbai, they’re more likely to walk away satisfied than if they visit a factory in Wuhan.China’s Strength: Scale, But With Risk

China makes more drugs than any other country. It controls roughly 80% of the global API supply. That’s not a small number-it’s a monopoly. When you need 10 tons of ibuprofen or 500 kilograms of amoxicillin, China is often the only place that can deliver it fast and cheap. But scale doesn’t equal safety. China’s manufacturing ecosystem is vast, but uneven. Large state-backed firms meet global standards. Smaller private suppliers? Not always. The FDA has issued import alerts against 37% of Chinese pharmaceutical facilities in 2023. That’s nearly double the rate for Indian facilities. These alerts mean shipments are automatically detained at U.S. ports until the company proves the product is safe. That’s not just a delay-it’s a financial hit. China’s push into biologics and advanced therapies has been aggressive. Its biopharmaceutical market grew at 19.3% annually between 2015 and 2024. That’s impressive. But it’s also a double-edged sword. Biologics are complex. A single batch can cost millions. If quality control slips, the consequences are severe. And with less transparency in reporting, regulators have less visibility into what’s happening on the factory floor.

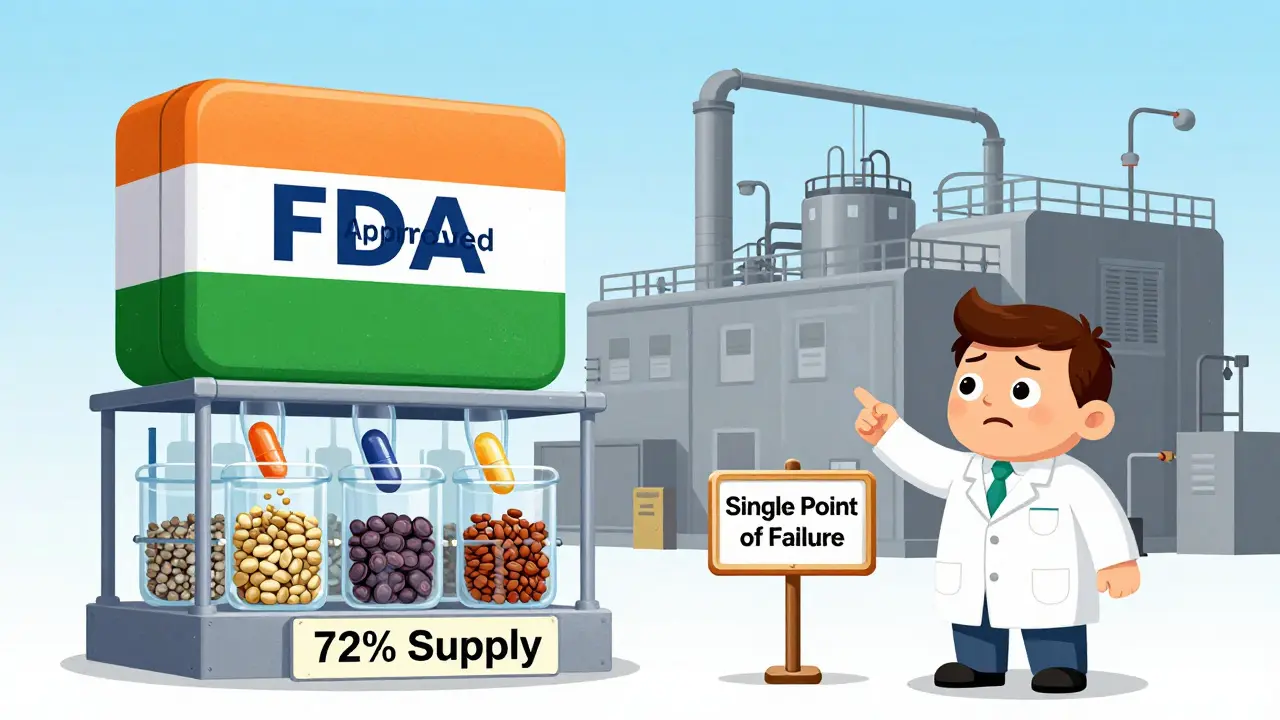

The Hidden Dependency: India’s API Problem

Here’s the twist no one talks about enough: India depends on China for its own drug ingredients. In FY2024, 72% of India’s bulk drug imports came from China. That’s up from 66% in 2022. So while India exports safe, FDA-approved pills to the U.S., the raw material inside them? Often made in China. This creates a single point of failure. If China restricts exports-due to politics, natural disaster, or regulatory shutdown-India’s entire supply chain could stall. One sourcing executive at a major U.S. drugmaker told Bain & Company: “We’re racing to fix this. We can’t keep depending on China for the foundation of our products.” India’s government is trying to fix this. The ‘Make in India’ initiative has poured nearly $3 billion into incentives for domestic API production. But building a chemical plant that meets FDA standards isn’t like building a smartphone factory. It takes years. And the cost? High. Companies are hesitant to invest when they can still buy cheap APIs from China.What Happens When the FDA Shows Up

FDA inspectors don’t ask for brochures. They want records. Batch logs. Environmental monitoring data. Equipment calibration reports. They check if the same person who mixes the powder also signs off on the final test. If there’s a mismatch, they note it. Indian facilities tend to have tighter documentation. Their staff are trained on 21 CFR Part 211-the FDA’s quality system rules for drug manufacturing. Chinese facilities? Often rely on older practices. Some still use paper logs. Others don’t track humidity levels in clean rooms. These aren’t minor details. Humidity can ruin a batch. Paper logs can be lost. And once the FDA finds a pattern of issues, they don’t just issue a warning-they block imports. Between 2020 and 2023, the number of FDA warning letters issued to Chinese manufacturers rose 40%. Meanwhile, India saw a steady decline. That’s not luck. It’s systemic.

The Future: Who Wins?

By 2047, India could be exporting $350 billion in pharmaceuticals. That’s not fantasy. It’s Bain & Company’s projection. But it hinges on two things: reducing reliance on Chinese APIs and moving into higher-value drugs like biosimilars and cell therapies. China, meanwhile, is losing ground in the eyes of Western regulators. Its share of the outsourced manufacturing market is expected to drop from 25% to 15% by 2030. Why? Because companies are tired of the risk. Even if Chinese factories are cheaper, the cost of recalls, delays, and reputational damage adds up. India’s advantage isn’t just in its plants. It’s in its people. Its regulatory culture. Its willingness to adapt. China’s advantage? It still holds the keys to the raw materials. But that’s changing. More companies are now investing in Vietnam, Mexico, and even the U.S. to diversify. India is the most ready to step in.What This Means for You

If you’re a patient, you’re probably safe. The FDA’s system, while imperfect, catches most problems before they reach shelves. But if you’re a pharmacist, a distributor, or a policymaker, you need to understand the real risks. The next drug shortage might not come from a pandemic. It might come from a single factory in China that gets shut down-or from India’s inability to replace its API imports. The truth? Neither country is perfect. But if you want reliable, safe medicine, India’s compliance track record gives it the edge. China still holds the volume. But volume without quality doesn’t last.Why does the FDA inspect factories in China and India?

The FDA inspects foreign factories because nearly 80% of the active ingredients in U.S. medications come from China and India. Even though drugs are sold in America, they’re often made overseas. The FDA ensures these facilities meet the same quality standards as U.S. plants to protect public health.

Which country has more FDA-approved drug plants: China or India?

India has more. As of 2024, over 100 Indian manufacturing sites are FDA-approved, compared to just 28 in China. This gives India a major advantage in supplying drugs to the U.S. and European markets.

Is Indian-made medicine safer than Chinese-made medicine?

On average, yes. Indian facilities receive fewer FDA violations and have stronger documentation systems. But safety depends on the specific factory, not the country. Some Chinese plants meet or exceed standards, while some Indian ones don’t. The difference is consistency-India’s top manufacturers are more reliably compliant.

Why does India import so much from China if it exports to the U.S.?

India makes finished drugs, but it doesn’t produce enough of the raw ingredients (APIs) itself. China supplies 72% of those ingredients at lower prices. So India imports APIs from China, then turns them into pills that meet FDA standards. This creates a hidden vulnerability in the supply chain.

Are U.S. drug companies moving away from China?

Yes, many are. The ‘China+1’ strategy is now common-companies keep some production in China but add India as a backup. Rising labor costs, geopolitical tensions, and repeated FDA warnings have made China riskier. India’s regulatory reliability and English-speaking workforce make it the top alternative.

Jonah Mann

So let me get this straight… India’s got 100 FDA-approved plants, China’s got 28? That’s wild. I thought China made everything. Turns out, they just make it *cheap*. And India? They make it *right*. Who knew compliance was the new competitive edge? Anyway, I’m just glad my blood pressure pills aren’t made in a basement somewhere with a guy named Bob signing off on batch logs with a Sharpie. 😅

February 8, 2026 AT 04:25

Tricia O'Sullivan

Thank you for this meticulously researched and soberly presented analysis. The distinction between scale and systemic compliance is not merely operational-it is ethically significant. The FDA’s rigorous oversight, though underappreciated by the general public, represents a vital safeguard in global pharmaceutical governance. One cannot overstate the importance of regulatory consistency in public health infrastructure.

February 10, 2026 AT 02:26

Simon Critchley

China’s API monopoly? More like a *strategic vulnerability* wrapped in a Chinese flag and dipped in low-wage sweat. Meanwhile, India’s playing 4D chess with FDA regs-digital monitoring, English-speaking QC teams, 21 CFR Part 211 on lock. It’s not just manufacturing-it’s pharma haute couture. And let’s be real: if your drug’s batch log is still on paper, you’re not a factory, you’re a museum exhibit. 🧪📉 #RegulatoryGangBang

February 10, 2026 AT 16:09

Andy Cortez

I don’t trust India. I mean, come on. They still use cow dung in some temples. How’s that not gonna leak into the antibiotics? And China? Yeah, they got warnings-but you think they care? They’re just gonna print more pills. This whole thing is a scam. FDA? More like FDA-Who? I’m switching to herbal tea.

February 12, 2026 AT 04:39

Jacob den Hollander

Man, I just read this whole thing and I’m kinda emotional. It’s not just about pills-it’s about trust. People think medicine is just science, but it’s also about people showing up, doing the paperwork, caring about humidity levels in a room no one else thinks about. That’s the quiet heroism. India’s not perfect, but they showed up. China’s got the volume, but not the heart. And yeah… that 72% API dependency? That’s our Achilles heel. We need to fund domestic production-not because it’s patriotic, but because it’s smart. We owe it to the nurses, the moms, the grandkids. This isn’t politics. It’s care.

February 12, 2026 AT 14:11

Andrew Jackson

The FDA’s inspections are a necessary evil-but let’s not pretend this is about safety. This is about American exceptionalism. India is being elevated not because it’s inherently superior, but because its workforce speaks English and doesn’t have a different flag. Meanwhile, China, the world’s most efficient manufacturer, is being demonized for economic success. This isn’t public health-it’s cultural bias masquerading as regulation. We are not being protected. We are being manipulated.

February 13, 2026 AT 12:54

PAUL MCQUEEN

Okay, but… did anyone else notice that this whole article just… assumes the FDA is infallible? Like, what if they’re just biased? What if Indian firms bribe inspectors? What if the 100 approved plants are just the ones that paid for the VIP tour? I’m not saying it’s true. I’m just saying… why do we accept this narrative without proof? Lazy.

February 15, 2026 AT 09:24

Kathryn Lenn

Ohhhhh so THAT’S why my generic Zoloft tastes like regret and battery acid. China’s 37% import alert rate? Yeah, I bet. And India? The FDA’s favorite cousin. Meanwhile, the real story? The FDA’s budget is cut every year, and half their inspectors are flying on expired visas. This whole thing’s a PR stunt. We’re not safer-we’re just better at pretending.

February 17, 2026 AT 08:35

Chima Ifeanyi

Let’s be brutally honest: this isn’t about quality. It’s about colonial nostalgia. India gets praised because it mimics Western systems. China is demonized because it refuses to kneel. The ‘China+1’ strategy? It’s just outsourcing to a more palatable dictatorship. And let’s not forget-India’s 72% API dependency on China proves they’re not independent. They’re just the middleman with better PowerPoint slides. Real sovereignty? That’s building your own supply chain. Not just copying FDA forms.

February 19, 2026 AT 03:22

Elan Ricarte

India’s got 100 approved plants? Cool. But let’s talk about the real elephant in the room: the FDA’s approval process is a revolving door. Companies pay for expedited reviews. Consultants ghostwrite compliance docs. The ‘28 vs 100’ gap? That’s not quality-it’s lobbying. And China? They’re building biologics while we’re still arguing over paper logs. You think your insulin is safe? Think again. The system’s rigged. And no one’s talking about it because the money’s too good.

February 20, 2026 AT 07:22

Angie Datuin

I just wanted to say thank you for writing this. As a nurse, I’ve seen patients panic when their meds change. I never knew why. Now I do. It’s not just about cost-it’s about trust. And trust is built in quiet rooms with calibrated machines, not headlines. This matters. More than we realize.

February 22, 2026 AT 03:51

Camille Hall

Love how this breaks it down without the usual ‘China bad, India good’ nonsense. The real story is the human infrastructure-the engineers, the QC techs, the bilingual auditors who show up at 5 a.m. to check humidity logs. That’s what makes the difference. And yeah, India’s dependency on Chinese APIs is terrifying. But it’s also a chance. We could help them build their own. Not just buy from them. Partner with them. That’s how we fix this.

February 22, 2026 AT 08:48

Ritteka Goyal

OMG I’m so proud of India!! 🇮🇳💖 We are the real pharma heroes!! China? Pfft, they just copy everything. We invented generic drugs!! We have the best scientists!! Our labs are clean, our people are hardworking, and we speak English!! Why do people still doubt us?? We’ve been making medicine for the world for decades!! And yes, we import from China-but that’s because they’re our little brother who needs help!! We’re gonna fix it!! Make in India is gonna make us the #1 pharma superpower!! Wait, is that true?? I read it on Instagram so it must be!! 💪💊

February 23, 2026 AT 20:49

Ashlyn Ellison

72% of India’s APIs come from China. That’s the real story. Not the 100 vs 28. The real risk isn’t in the factory-it’s in the pipeline. One border closure, one shipping delay, one political tantrum-and millions of prescriptions stall. We’re not preparing for that. We’re just hoping.

February 24, 2026 AT 22:05

Ryan Vargas

Let’s not forget the deeper philosophical underpinnings here. The FDA’s inspection regime is not merely regulatory-it is a metaphysical assertion of Western epistemology over Eastern pragmatism. China’s model-efficient, scalable, opaque-represents a postmodern rejection of Enlightenment ideals of transparency and accountability. India, by contrast, has internalized the Cartesian imperative: ‘I document, therefore I am.’ The real crisis isn’t supply chains. It’s the erosion of the very notion that truth can be recorded, verified, and trusted. If a batch log is lost in a Chinese factory, and no one reads it… does the drug still exist?

February 24, 2026 AT 22:30